Jan 22, 2026

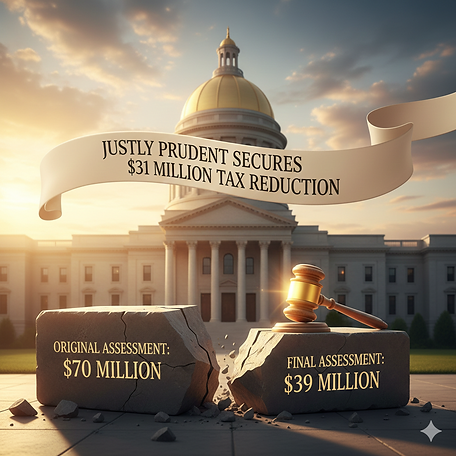

On January 22, 2026, Justly Prudent announced the settlement of a lawsuit challenging Maryland's tax assessment practices, securing a $31 million reduction for property owners who had faced financial ruin.

The settlement reduces the assessed value of The Oxford, a luxury apartment complex in Oxon Hill, from $70 million to $39 million. The revised figure is actually $10 million lower than the property's previous assessment, confirming what the owners had argued all along: the State's valuation methods were fundamentally flawed.

The property owners faced more than $1 million in additional taxes based on the inflated assessment. Because both owners personally guaranteed the property's loans, they risked losing everything. The settlement eliminates that threat and saves them hundreds of thousands of dollars in taxes.

The case also challenged a Maryland law that prohibits courts from stopping tax collection under any circumstances, even when the assessment violates constitutional rights. The lawsuit argued this law unconstitutionally stripped judges of their power to provide relief against ongoing government misconduct.

The settlement came just hours before a scheduled hearing on the State's motion to dismiss the case.